Learn more about Artificial Intelligence in the Enterprise

Why Financial Services Leaders Prioritise AI

%20(1).png?width=120&height=120&name=Untitled%20(250%20x%20250%20px)%20(1).png)

Operational Efficiency

Reduce operational costs by up to 30% with targeted process automation and AI-driven workflows

Customer Experience

Enhance customer satisfaction by 25% with personalised service delivered through AI-powered support systems.

.png?width=120&height=120&name=500x%20DFP%20(20).png)

Revenue Growth

Improve sales conversion rates by up to 20% using predictive analytics and personalised customer insights.

Our AI Readiness Frame Work for Financial Services

Assessment

Our comprehensive AI readiness assessment evaluates your organisation's current capabilities across key dimensions, including data, technology, and governance.

Strategy

Based on assessment results, we develop a tailored AI strategy aligned with your business goals, regulatory requirements, and technical capabilities.

Implementation

Our team of financial services AI specialists guides implementation, ensuring seamless integration with existing systems and processes.

AI Applications in Financial Services

Automated Compliance and Regulatory Reporting

Implement AI-driven tools to automatically monitor transactions and detect compliance issues in real-time, drastically reducing manual checks and mitigating compliance risks.

Fraud Detection and Risk Management

Utilise advanced AI algorithms and machine learning to quickly identify suspicious patterns, enabling proactive intervention and significantly reducing financial losses.

Loan and Credit Application Processing

Apply AI for instant analysis of loan and credit applications, automating approval workflows, reducing decision times, and minimising errors caused by manual assessments.

AI-Powered Form Automation

Utilise AI to automatically populate and validate forms, significantly reducing manual input errors, accelerating application processes, and improving accuracy in client onboarding and data management.

Automated Client Reporting and Personalised Insights

Implement AI-powered reporting tools that automatically generate detailed, personalised client performance reports, providing tailored insights, improving client satisfaction, and freeing up advisors' time for higher-value interactions.

AI-Powered Data Cleansing and Validation

Utilise AI and machine learning to automatically identify, correct, and enrich financial datasets, significantly improving data accuracy, integrity, and reliability. This reduces the effort and errors associated with manual data management, ensuring decisions are based on high-quality, trustworthy information.

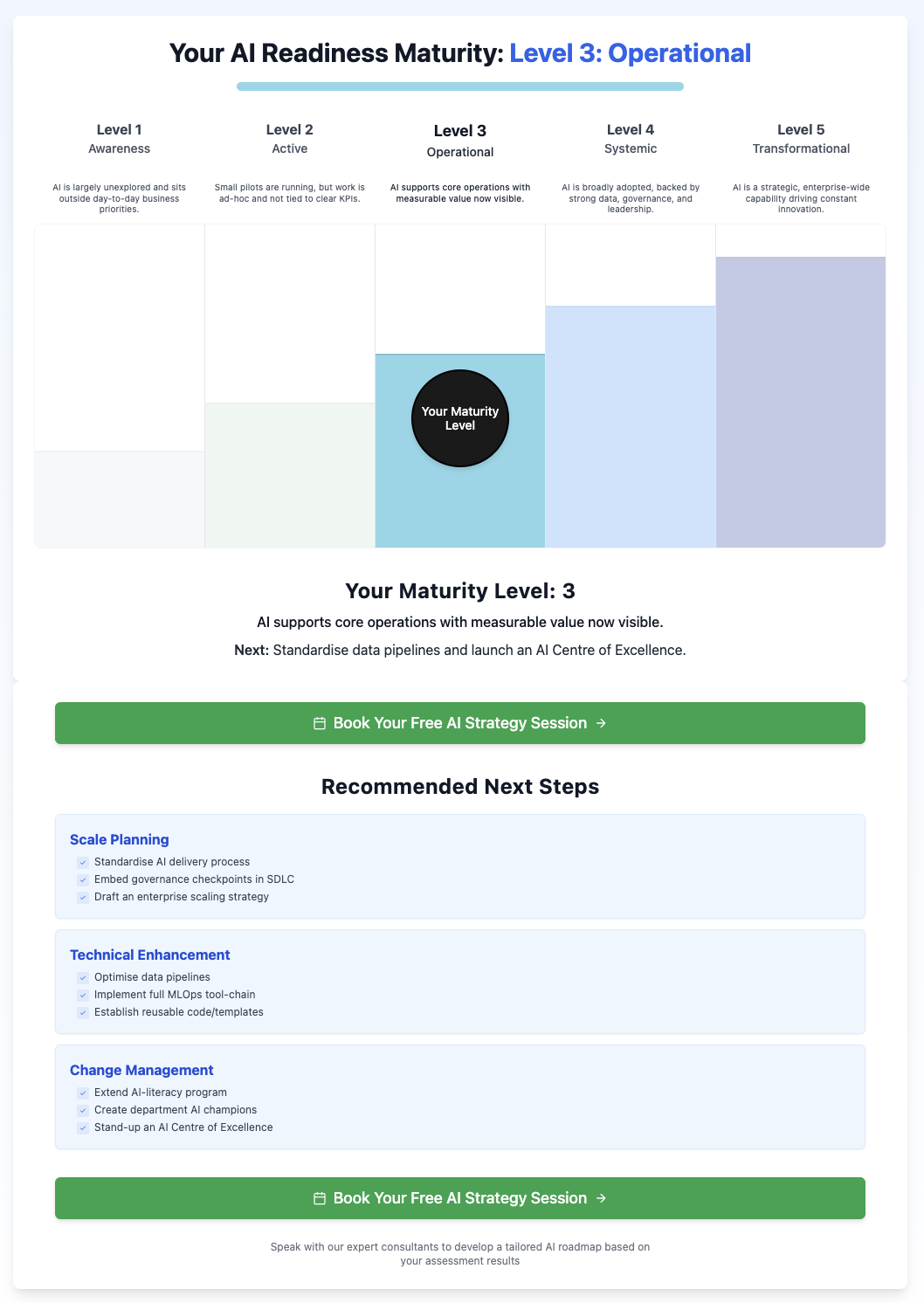

Assess Your AI Readiness & Accelerate Your Journey For Free

Discover where your organisation stands on the AI maturity scale with our complimentary AI Readiness Assessment.

We offer a collaborative approach where our financial services specialists conduct a comprehensive evaluation with you during a personalised strategy session. This expert-guided assessment provides deeper insights across key dimensions, including data readiness, governance, and technical capabilities, tailored specifically to your organisation's unique challenges. See how our AI Readiness Assessment can transform your operations with our sample report.

Our Financial Services Senior Leadership

Chris Stevens

CEO & Managing Partner

Seasoned professional in financial services technology transformation, strategic project delivery, and technology governance, holding significant senior leadership roles at Vanguard Investments as CIO, Westpac in senior management positions overseeing strategic sourcing and IT service delivery, and ANZ Bank in executive IT operations roles.

%20(4).png?width=250&height=250&name=Untitled%20(250%20x%20250%20px)%20(4).png)

Peter Hagenauer

COO & Partner

Extensive senior banking experience from ANZ Banking Group, where he held senior roles including Head of eCommerce Business Applications for Global Markets, Associate Director Capital Markets eCommerce, and Manager Financial Products, and earlier at Deutsche Bank foreign exchange sales.

Pieter Snyman

CTO & Partner

Strong track record in cybersecurity, data science, and AI solutions. Pieter has significant senior technology leadership experience, including positions as Vice President and Head of IT Development at Deutsche Bank, Head of IT at Cadiz Securities, and Chief Information Officer at South African Airways, specialising in cybersecurity, artificial intelligence, and electronic trading systems.

FAQ's About AI in Financial Services

How quickly can we see ROI from AI implementation?

Most of our financial services clients see initial ROI within 3-6 months of implementation. The exact timeline depends on your specific use cases, but our assessment process helps identify quick wins that can generate immediate value while building toward longer-term strategic objectives.

What security measures protect our financial data?

We implement enterprise-grade security measures, including end-to-end encryption, role-based access controls, and compliance with financial industry standards (ISO 27001, SOC 2). Your data never leaves your secure environment, as our solutions are designed to integrate with your existing security infrastructure.

How does the AI Readiness Assessment work?

Our assessment evaluates your organisation across nine key dimensions, including strategic alignment, data readiness, technical infrastructure, and team capabilities. The process typically takes 2-3 weeks, including stakeholder interviews, systems evaluation, and data analysis. You’ll receive a comprehensive report with specific recommendations and a roadmap for implementation.

What makes your approach different for financial services?

Unlike general AI consultancies, our team comes directly from the financial services industry and has experience at institutions like ANZ, Deutsche Bank, and Westpac. We understand the unique regulatory requirements, data sensitivity needs, and use cases specific to financial services, allowing us to deliver both compliant and effective solutions.

Do we need technical expertise to get started?

No technical expertise is required to begin. Our process is designed to be accessible to business leaders while engaging technical stakeholders as needed. We bridge the gap between business objectives and technical implementation, guiding you through each step of the process.

Book a meeting to get a free consultation

.png?width=250&height=250&name=500x%20DFP%20(19).png)